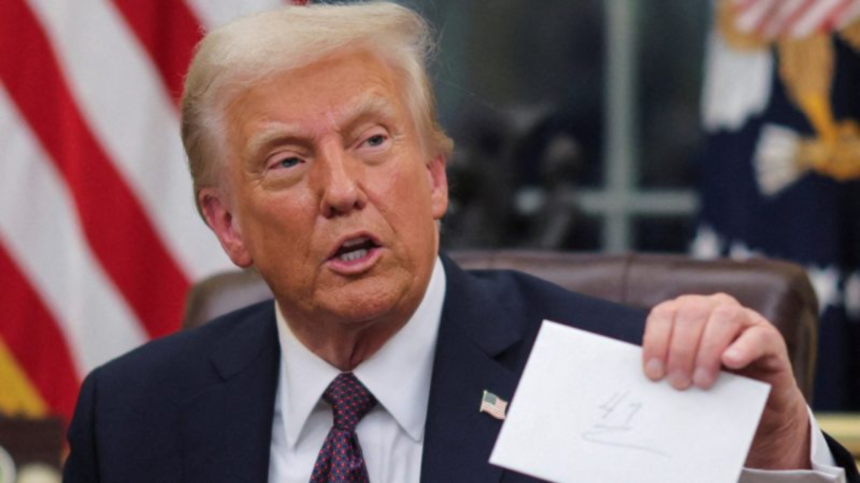

President Donald Trump ignited controversy Thursday morning after launching a scathing attack on Federal Reserve Chair Jerome Powell, calling for his removal and blaming him for not slashing interest rates fast enough.

In a fiery social media post, Trump wrote:

“The ECB is expected to cut interest rates for the 7th time, and yet, ‘Too Late’ Jerome Powell of the Fed, who is always TOO LATE AND WRONG, yesterday issued a report which was another, and typical, complete ‘mess!’ Oil prices are down, groceries (even eggs!) are down, and the USA is getting RICH ON TARIFFS. Too Late should have lowered Interest Rates, like the ECB, long ago, but he should certainly lower them now. Powell’s termination cannot come fast enough!“

The post immediately drew rebukes from political analysts, economists, and critics across the spectrum.

Attorney George Conway mocked the tirade with legal satire, referencing the landmark Humphrey’s Executor v. United States decision, while constitutional law professor Laurence Tribe chimed in, interpreting Conway’s sarcasm as highlighting the illegality of Trump’s suggestion to fire Powell unilaterally.

Progressive media outlet MeidasTouch labeled the post an “early morning tantrum,” accusing Trump of lashing out after Powell pointed to the inflationary risks of Trump’s tariff-heavy economic agenda.

Meanwhile, Republicans Against Trump noted the irony of Trump’s criticism, reminding followers that Powell was originally appointed by Trump himself. The group added that threatening the Fed only adds instability to already volatile financial markets.

Commentator Brian Krassenstein summarized the contradiction, writing:

“Trump demands lower interest rates while implementing inflationary tariffs — it’s like pouring gasoline on a fire and then blaming the fire department for not putting it out fast enough.”

Trump’s post came just days after Powell’s report warning that Trump’s tariff policies could fuel inflation and hamper economic growth, undercutting Trump’s public claim that tariffs are making America “rich.”

With markets sensitive to Federal Reserve signals and independence, Trump’s renewed push for political control over the central bank is likely to trigger further scrutiny — both legally and economically — in the lead-up to the 2026 midterms.